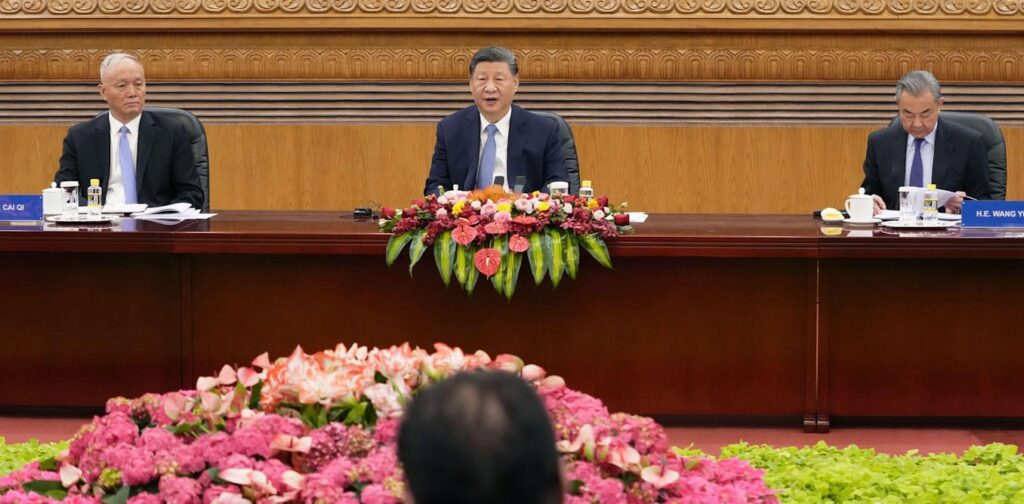

China’s president Xi Jinping lately held a meeting with 40 leaders of multinational firms, together with BMW and AstraZeneca.

In distinction to Donald Trump’s rhetoric, Xi instructed the highest stage executives that globalisation was not going away. Xi is making an attempt to spice up foreign investment in China, which has dropped in the previous few years, and construct new relationships that may offset Trump’s tariffs on many Chinese language items.

Within the March 28 assembly, Xi “vowed to improve market access” and warranted company leaders that “lines of communication” between them and the Chinese language authorities are open.

Xi is hoping to construct on an anti-Trump bounce and encourage companies to again Beijing as some indicators emerged that China’s financial system was doing somewhat higher than anticipated in early 2025. Industrial manufacturing went up by 5.9% in January and February. Credit score development, which measures the quantity of loans banks give out, additionally seems to be picking up, suggesting that companies is perhaps growing in China.

Retail gross sales, that are a major economic marker indicating client spending, has risen by up to 4% in January and February this 12 months, in comparison with final 12 months.

Beijing can also be keen to create additional stimulus packages to maintain China’s financial development, which could elevate client confidence additional.

However that is hampered by a real estate crisis that started in 2021. What adopted was an already excessive local government debt that was exacerbated by the property disaster, and excessive youth unemployment that existed since 2023.

The massive query then is what are the elements that might result in a extra buoyant outlook in China’s financial fortunes?

Beijing’s coverage resolve

Based on a Bloomberg report, China has historically relied on low-cost loans and subsidies to spice up financial sectors in infrastructure, manufacturing, and the property market. Nonetheless, these occasions are over.

The issue is China has produced extra items to promote than individuals are keen to purchase. Up to now, Beijing relied on the west to buy its merchandise, however with rising protectionism and looming tariffs stemming from a Donald Trump-led US, US consumption of Chinese language items is prone to fall.

And if one other key market within the type of the EU had been to take a cue from Trump’s financial playbook and impose extra tariffs on China, then Chinese language hope for gross sales within the west for financial development could not materialise.

Beijing’s surest method of boosting gross sales is thru home consumption. This isn’t simple as China’s home spending stays comparatively low at 40% of the country’s GDP, which is about 20% decrease than the worldwide common. And if Beijing needs cautious customers to spend amid a comparatively weak economic outlook, it must do extra to lift client confidence.

EPA-EFE/WU HAO

Though China did introduce a stimulus package in September 2024, it has resolved to do extra. In an early March 2025 speech within the Chinese language parliament, Chinese language premier Li Qiang promised a “special action plan” to vigorously increase home consumption for 2025. A number of weeks later Li reiterated within the China Improvement Discussion board that Beijing would roll out extra stimulus packages when the necessity arose.

These assurances are prone to have helped enhance market sentiment, and the truth that China’s GDP development goal was additionally set at an ambitious stage of round 5%, would possibly sign Beijing’s confidence and resolve that the financial system will enhance.

China’s AI revolution

Up to now, China was thought of a copycat nation identified for manufacturing shanzai, or fake and pirated merchandise. This difficulty in innovating and reliance on the designs of others largely lay with an education system steeped in rote learning, and a top-down tradition with a conformist approach.

Because of this specialists thought China would wrestle when the US determined to introduce restrictions on Chinese language entry semiconductor and AI applied sciences. Nonetheless, regardless of these restrictions, China has managed to develop a extremely succesful AI mannequin of its personal within the type of DeepSeek, which was unveiled early this year, and instantly boosted China’s picture as an innovator.

Not like different AI fashions, DeepSeek was apparently made at a fraction of the price of different conventional AI fashions comparable to ChatGPT, and should have a more efficient coding scheme that enables for faster downside fixing. This has prompted Donald Trump to coin DeepSeek’s improvement as a wake-up call for the US tech business.

Many AI startups in China at the moment are revamping their business models to compete with DeepSeek, following widespread adoption of the latter’s expertise. Because the AI revolution in China may probably scale back prices and thereby boost efficiency within the monetary sector.

Following Trump’s return to the Oval Workplace, buyers throughout the globe have been making an attempt to scale back their reliance on the US by searching for investment opportunities elsewhere. This isn’t solely shocking given Trump’s knack for the unpredictable, and the way new US tariffs have been utilized to a bunch of US allies comparable to Mexico, Canada, and the European Union.

Whereas Trump is hanging an more and more protectionist tone, China is taking the alternative strategy. Trump’s penchant for tariffs and disrespect for the financial curiosity of US allies could imply Beijing may not must do an excessive amount of to draw extra nations and companies to contemplate turning in the direction of Chinese language markets.