Donald Trump set a deadline of July 9 2025 for commerce offers to be made earlier than he hits a few of the world’s largest economies together with his controversial tariffs. It’s not possible to foretell what is going to occur on the day, however it’s already clear that his financial insurance policies are damaging American pursuits.

Simply take a look at the state of US authorities debt for instance. At present it stands at US$36 trillion (£26 trillion). And with whole financial output (GDP) value US$29 trillion per 12 months, that debt is 123% of GDP, the very best it has been since 1946.

Authorities money owed are alarmingly excessive in different international locations too (the UK’s is at 104% of GDP, with France at 116% and China at 113%), however the US is in the direction of the high quality.

The lately handed funds reconciliation invoice (what Trump calls the “large stunning invoice”) is projected to add US$3 trillion to that debt over the following decade. With these kinds of numbers, there’s little prospect of placing US debt on a downward observe.

Get your information from precise consultants, straight to your inbox. Sign up to our daily newsletter to obtain all The Dialog UK’s newest protection of stories and analysis, from politics and enterprise to the humanities and sciences.

In 2024, the US authorities needed to borrow an additional US$1.8 trillion to cowl spending not supported by tax income (the funds deficit). That is equal to six.2% of GDP, a quantity that’s officially predicted to rise to 7.3% in the course of the subsequent 30 years.

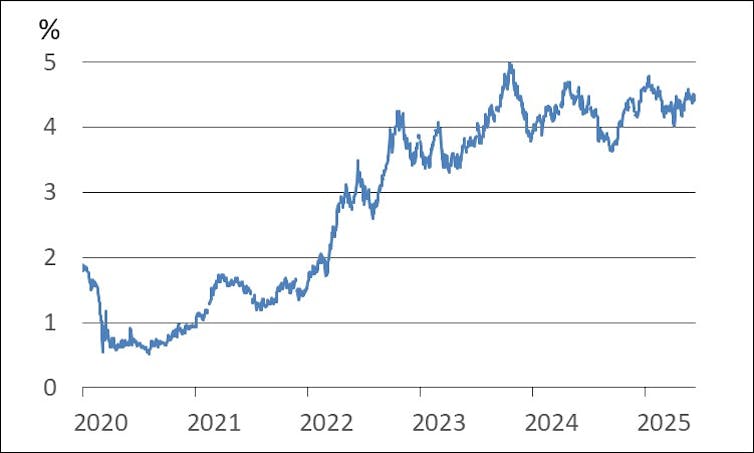

Writer’s chart utilizing information from Federal Reserve Financial institution of St. Louis, Writer supplied (no reuse)

The predictable consequence of this fiscal profligacy and the chaotic tariff programme is the excessive charges of curiosity that the US authorities is having to pay for its borrowing.

As an example, the rate of interest on ten-year US authorities debt (in any other case referred to as its yield) has risen from 0.5% in mid-2020 to 4.3% now. And as authorities debt yields rise, so do rates of interest on mortgages and company borrowing.

The ability of the greenback

For many years, the USA has loved a excessive degree of belief within the power, openness and stability of its economic system.

In consequence, US bonds or “treasuries”, the monetary property that the federal government sells to lift cash for public spending, have lengthy been thought of protected investments by monetary establishments world wide. And the US greenback has been the dominant forex for worldwide funds and money owed.

Typically known as “exorbitant privilege”, this standing of the US greenback because the world’s reserve forex brings large benefits. It advantages US customers by making imported items cheaper (albeit contributing to the commerce deficits (when US imports to a rustic are value greater than its exports) which bother the president so much).

It additionally means the US authorities can borrow some huge cash earlier than doubts come up about its capacity to repay. Traders will typically purchase as many bonds because the US govt must situation to pay for its spending.

The dominance of the greenback in worldwide transactions additionally brings political energy, corresponding to the power to exclude Russia from main world cost methods.

However this privilege is being eroded by the US president’s tariff agenda. Financial motives apart, it’s the manner they’re being utilized – their measurement and the unpredictability – that’s actually sapping investor confidence.

It’s pricey to regulate buying and selling patterns and provide chains in response to tariffs. So when the scope of future tariffs is unknown, the rational response is to cease investing whereas awaiting higher certainty.

The greenback has lost 8% in worth for the reason that starting of the 12 months, reflecting investor doubts concerning the US economic system, and making imports much more costly.

Monetary markets are weak

However maybe the most important hazard to US monetary markets is a sudden rise in yields on authorities debt. No investor needs to be left holding a bond when its yield rises as a result of – as with all fixed-interest debt – the rise in yield causes the bond’s market worth to fall. It is because new bonds are issued with a better yield, making current bonds much less engaging and fewer worthwhile.

A bond holder anticipating an increase in yield subsequently has an incentive to promote it earlier than the rise happens. However the rise in yield can change into self-reinforcing if the scramble to promote turns into a stampede.

Certainly, there was a jump in US yields after the will increase in commerce tariffs introduced on “liberation day” in early April, with the yield on ten-year treasuries rising by 0.5% in simply 4 days.

Dilok Klaisataporn/Shutterstock

Happily, this rise was halted on April 10 when the tariffs have been abruptly paused, allegedly in response to the autumn in bond costs and an accompanying fall in share costs. The opinion of a senior central banker, that monetary markets had been close to “meltdown”, was considered one of several such warnings.

The greenback is unlikely to be shortly dislodged from its pedestal because the world’s reserve forex, because the options aren’t engaging. The euro isn’t appropriate as a result of it’s the forex of 20 EU international locations, every with its personal separate authorities debt. Neither is the Chinese yuan a likely contender, given the Chinese language authorities involvement in managing the yuan trade price.

However since March, international central banks have been selling off US treasuries, typically selecting to carry gold as a substitute.

On Trump’s watch, the status of the US greenback as the final word protected asset has been tarnished, leaving the monetary system extra weak – and borrowing costlier.