U.S. President Donald Trump has imposed a 25 per cent tariff on most Canadian goods. A senior governmental official mentioned they’re anticipated to return into impact on Feb. 4.

This tariff could have vital financial penalties on either side of the border, because the U.S. and Canada share one of the largest bilateral trade relationships in the world.

A key concern is the highly integrated supply chains between the two countries. Many items cross the border multiple times as intermediate inputs before becoming final products. Imposing tariffs at any level on this provide chain will elevate manufacturing prices and improve costs for a variety of products traded between the U.S. and Canada.

For Canada, the tariffs on Canadian merchandise will considerably have an effect on Canada’s competitiveness within the U.S. market by driving up costs. Such tariffs may pose critical challenges for varied sectors in Canada, given the nation’s heavy reliance on the U.S. economic system.

Results on totally different sectors

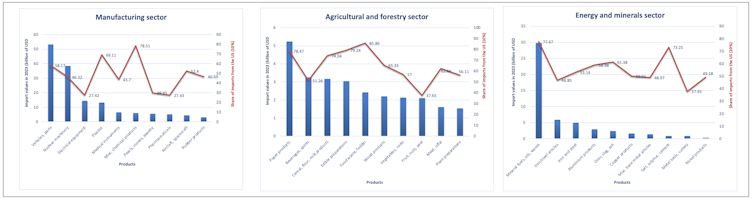

The influence of U.S. tariffs on Canadian costs is more likely to differ throughout sectors and merchandise, relying on their reliance on the U.S. market.

Sectors with the next dependence on U.S. commerce are more likely to expertise extra extreme disruptions. If the tariffs make sure merchandise uncompetitive, Canadian producers might battle to safe various markets within the brief time period.

Industries equivalent to agriculture, manufacturing and power will expertise various levels of influence. Energy products and motor vehicles, which represent Canada’s largest exports to the U.S., are anticipated to be among the many most adversely affected.

(World Built-in Commerce Answer)

Within the agricultural and forestry sector, wooden and paper merchandise, together with cereals, are amongst Canada’s largest exports to the U.S., with the U.S. accounting for 86 to 96 per cent of those exports, in keeping with information from the World Integrated Trade Solution.

Within the power and mineral sector, crude oil is Canada’s prime export, reaching US$143 billion in 2023, with 90 per cent destined for the U.S. Given its important position as Canada’s largest export throughout all sectors, it is not surprising that Trump has noted crude oil would subject to a lower tariff of 10 per cent.

Canada’s dependence on U.S. commerce

When inspecting the influence on totally different merchandise, it’s not solely the worth of commerce that issues, but additionally the share of commerce. The share of commerce signifies how reliant Canada is on the U.S. in comparison with different markets.

A excessive commerce share with the U.S. suggests a product is especially weak to commerce disruptions, as Canada relies upon closely on the U.S. marketplace for that product. Conversely, a decrease share signifies that Canada has diversified suppliers, which reduces its dependence on the U.S.

Learn extra:

Trump’s tariff threat could shake North American trade relations and upend agri-food trade

As an illustration, in 2023, Canada’s prime exports to the U.S. included automobiles and components, nuclear equipment and plastics, in keeping with information from the World Integrated Trade Solution. The U.S. accounted for 93 per cent of car and components exports, 82 per cent of nuclear equipment exports, and 91 per cent of plastics exports.

This information highlights Canada’s excessive dependence on the U.S. market, making these industries inside the manufacturing sector extremely inclined to the tariff. This might hurt jobs within the manufacturing sector, which is important to employment in Canada, offering jobs for over 1.8 million people.

Canada’s reliance on the U.S. can also be evident in imports. In 2023, car imports totalled US$92 billion, with the U.S. accounting for 58 per cent of that quantity.

(World Built-in Commerce Answer)

The dependence can also be evident within the agri-food and forestry sector, the place Canada closely depends on U.S. imports. This implies that retaliatory tariffs on agricultural items from the U.S. may have a considerable influence on meals costs in Canada.

Retaliatory tariffs and inflationary pressures

Canada has introduced it’s imposing $155 billion of retaliatory tariffs on U.S. imports in response. This might contribute to inflationary pressures inside Canada.

Prime Minister Justin Trudeau says this consists of instant tariffs on $30 billion value of products as of Tuesday, adopted by additional tariffs on $125 billion value of American merchandise in 21 days’ time to “permit Canadian corporations and provide chains to hunt to seek out options.”

This can embody tariffs on “on a regular basis objects equivalent to American beer, wine and bourbon, fruits and fruit juices, together with orange juice, together with greens, fragrance, clothes and footwear,” and likewise on main shopper merchandise like family home equipment, furnishings and sports activities gear, and supplies like lumber and plastics.

Given Canada’s vital dependence on U.S. imports, the retaliatory tariffs will elevate the price of American items coming into the nation, additional driving up shopper costs and exacerbating inflation.

In its latest policy rate announcement, the Financial institution of Canada warned of the extreme financial penalties of Trump’s tariffs, highlighting their potential to reverse the present downward development in inflation.

THE CANADIAN PRESS/Chris Younger

What ought to Canada do now?

Canada should prolong its financial diplomacy efforts past the Trump administration, partaking with the U.S. Congress and Senate to advocate for the reconsideration of tariffs on Canadian items. The Canadian authorities ought to persist in leveraging this channel to push for a reversal of the tariffs. This sort of broader negotiation stays the best strategy to mitigating commerce tensions and guaranteeing secure financial relations with the U.S.

On the similar time, Canada should scale back dependence on the U.S. market by adopting a complete export diversification technique. Whereas the U.S. stays a handy and accessible commerce companion, increasing into rising and growing markets would assist mitigate dangers and create extra secure long-term commerce alternatives.

Learn extra:

Trump’s tariff threat is a sign that Canada should be diversifying beyond the U.S.

One efficient approach to obtain export diversification is by increasing free commerce agreements (FTAs) with rising and growing economies. At present, Canada has 15 FTAs covering about 51 countries, however there’s room for growth. Nonetheless, signing FTAs alone is inadequate; Canada should guarantee these agreements translate into tangible commerce progress with companion international locations.

Worldwide politics is more and more shaping world commerce, making it crucial for Canada to proactively handle diplomatic and commerce relations. In recent times, tensions have emerged with key companions equivalent to China, India and Saudi Arabia. These international locations may all turn into potential markets for Canadian merchandise. Given that China is Canada’s second-largest export destination, there’s vital potential to increase commerce ties.

Moreover, international locations just like the United Arab Emirates current promising markets, notably for agricultural merchandise, as the UAE imports about 90 per cent of its food.

(AP Picture/Ben Curtis)

Boosting innovation and productiveness

Canada stands at a important juncture in its commerce relationship with the U.S. Whereas diplomatic efforts stay important to averting dangerous tariffs, they can’t be the nation’s solely line of defence.

Boosting productiveness is without doubt one of the handiest methods for Canada to enhance its competitiveness in world markets. Canadian producers ought to prioritize innovation and the adoption of superior applied sciences to reinforce effectivity and keep a aggressive edge, notably as they search to increase past the U.S.

In response to potential U.S. tariffs, the Canadian authorities ought to implement a bailout technique to offer short-term aid and mitigate income losses to corporations that shall be largely affected. Moreover, Canada ought to leverage its embassies and consulates worldwide to advertise exports and assist affected corporations establish and entry new market alternatives.

By doing this, Canada can place itself as a extra self-reliant and aggressive participant within the world economic system — one much less weak to shifting U.S. insurance policies.