The world has witnessed a resurgence of protectionism since Donald Trump returned to the White Home. So-called “reciprocal” tariffs, imposed on all US buying and selling companions at various levels primarily based on the tax they cost on American items, have been one of many hallmark options of Trump’s financial coverage. They goal to right what he perceives as “unfair” commerce practices.

In early April, Trump said many countries had “ripped us off left and proper” and declared “now it’s our flip to do the ripping”. His administration swiftly imposed sweeping tariff increases, with a number of the highest charges falling on poorer international locations like Laos and Lesotho.

A 90-day suspension was eventually made for many of those tariffs, and Trump has now softened duties on imported automobiles and automobile components. However the hazard stays excessive. Nobody could be sure that the preliminary reciprocal tariffs is not going to be reinstated.

Creating international locations, a lot of which rely closely on the export of manufactured items to the US, can be retaining a eager eye on what occurs subsequent.

Kim Ludbrook / EPA

We employed the Global Trade Analysis Project mannequin to analyse the attainable results of US tariffs on commerce and financial progress. The mannequin captures interactions and suggestions amongst financial brokers (households, companies and governments), markets, sectors and areas on the planet financial system.

It may be used to forecast the impact of commerce reforms on numerous indicators akin to manufacturing, welfare, earnings, costs and commerce flows. Based mostly on sure assumptions, the modifications are prone to be seen in between two and three years.

We used simulations to compute the consequences of Trump’s tariff regime underneath two various situations. Within the first, which displays the worldwide commerce scenario on the time of writing, baseline tariffs are levied on all international locations at 10%. The duties are 25% on items from Canada and Mexico, and 145% on China. Retaliatory duties by China on US items are set at 125%.

Within the second, across-the-board reciprocal tariffs are imposed on international locations on the ranges Trump declared in his preliminary plan on April 2. That is along with the 145% tariff on Chinese language items, 25% on these from Canada and Mexico and a 125% responsibility by China on imports from the US.

Winners and losers

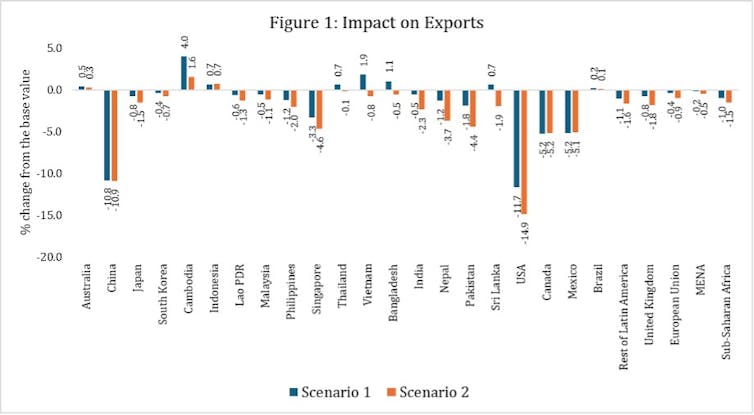

As proven by the graph beneath, our simulations recommend the US tariff regime will distort export patterns worldwide. Probably the most painful results will fall on China and the US itself.

Chinese language exports would shrink by 10.8% within the first state of affairs and 10.9% within the second. The US would endure a good bigger lack of 11.7% and 14.9%, respectively.

The mannequin means that different main US buying and selling companions akin to Canada and Mexico would additionally expertise deep export declines of over 5% in each situations. Roughly 75% of Canada’s exports head south towards the US.

Among the many growing Asian economies, Nepal, Pakistan and the Philippines would expertise substantial export declines. That is notably the case within the second state of affairs, with losses starting from 2% to 4.4%. These international locations are notably weak to reciprocal tariffs as a result of they rely closely on exports and are deeply tied to international provide and manufacturing chains.

Bangladesh, Cambodia, Indonesia, Sri Lanka and Vietnam could profit within the first state of affairs as a consequence of a attainable diversion of commerce. These international locations, that are identified for having a number of the lowest labour prices on the planet, provide low-cost options for items that US importers would beforehand have sourced from China.

However they’re anticipated to lose the vast majority of these advantages within the second state of affairs underneath a full reciprocal tariff regime. The exceptions are Cambodia and Indonesia, which our simulations recommend will retain optimistic export progress – albeit decreased to 1.6% from 4% for Cambodia and unchanged at 0.7% for Indonesia.

This can be as a result of Cambodia and Indonesia have barely extra diversified export baskets than international locations like Bangladesh and Sri Lanka, and commerce with extra companions. Nevertheless, these good points are prone to be brief lived if international uncertainties proceed.

Main superior economies akin to Japan, the UK and EU will lose exports by a average quantity. And the Center East, north Africa, sub-Saharan Africa and Latin America (excluding Brazil) will see comparable declines.

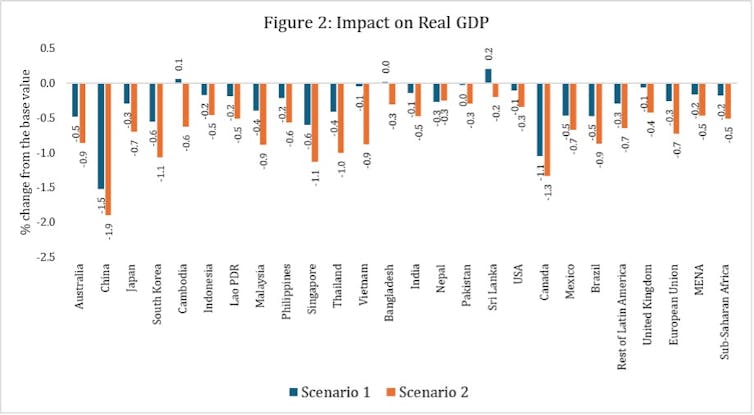

The second graph presents a regarding image of how commerce disruption might have an effect on GDP, which economists use to measure the scale of a rustic’s financial system. The US and China are once more set to endure the steepest GDP losses, of 0.3% within the US and 1.9% in China underneath the second state of affairs. This confirms the well-established economic consensus that commerce wars are mutually harmful.

Beneath the second state of affairs, most rising and growing economies would endure modest GDP declines between 0.3% and 1%. Thailand (1%), Malaysia (0.9%), Brazil (0.9%) and Vietnam (0.9%) are the worst hit international locations on this class.

Like many of the growing international locations in Asia, which aren’t immediately concerned within the commerce struggle, many international locations in Latin America, the Center East, north Africa and sub-Saharan Africa would nonetheless face hits to their GDP. This underscores the worldwide interconnectedness of commerce and funding flows.

The simulations affirm what economists have been asserting for years: commerce wars do not have winners. Whereas some international locations do profit within the brief time period by the use of commerce diversion, the full losses are excessive and growing international locations will not be immune from the harm.

Nevertheless, there are methods growing international locations can make use of to enhance their resilience to international commerce disruptions. This contains diversifying their export markets by, for instance, establishing stronger commerce ties in regional blocs.

One instance is the Regional Comprehensive Economic Partnership, a free commerce settlement between the Asia-Pacific nations of Australia, Brunei, Cambodia, China, Indonesia, Japan, South Korea, Laos, Malaysia, Myanmar, New Zealand, the Philippines, Singapore, Thailand and Vietnam. Such ties could be strengthened additional.

Creating international locations must also use this turbulent interval to streamline customs, improve port infrastructure and enhance logistics. This will scale back prices, improve competitiveness and assist growing economies engage more deeply in worldwide commerce.

No nation is exempt from disruptions to international commerce. However these with diversified economies, sturdy regional linkages and resilient commerce infrastructure will climate the turbulence extra efficiently.