Not lots is understood concerning the authorities’s plans for taxes within the 2025 price range. Few tax insurance policies have been introduced to date, and what has been revealed entails focused tax cuts for enterprise pursuits.

This can be a massive change from final 12 months’s tax bulletins, which had been largely focused on individuals.

To date this 12 months, the federal government has introduced tax insurance policies to encourage overseas investment and to make worker share schemes for start-ups and unlisted corporations extra engaging.

This week, the federal government additionally introduced the demise of the Digital Services Tax – which Treasury estimated could be price greater than NZ$100 million a 12 months – after threats of retaliation from US President Donald Trump.

However every of those insurance policies would end in a drop in tax income. That raises a key query: the place will the cash to run the federal government come from when two successive budgets have included tax income cuts?

Abroad cash for funding

This month, the federal government introduced a dedication of $75 million over the next four years to encourage overseas funding in infrastructure and make it simpler for startups to draw and retain prime quality workers.

Damaged down, this might be $65 million for a change to the principles round “skinny capitalisation”, pending the end result of session on the small print. At a fundamental degree, this coverage is focusing on how a lot debt corporations with abroad subsidiaries can have when investing in New Zealand infrastructure.

The opposite $10 million is earmarked as a deferral of tax legal responsibility for some worker share schemes to assist startups and unlisted corporations.

The objective of each insurance policies appears to be to encourage worldwide funding in New Zealand to spice up development in our in any other case sluggish economic system.

Hagen Hopkins/Getty Images

No digital providers tax

The demise of the digital providers tax is the opposite massive tax coverage to be introduced forward of right this moment’s price range.

Left over from the earlier Labour authorities, the coverage would have utilized a 3% tax on digital providers income earned from New Zealand clients by world tech giants akin to Meta, X and Google (a lot of that are based mostly within the US).

However Donald Trump has been extremely vital of those kinds of levies, describing them as abroad extortion. Income Minister Simon Watts has admitted Trump’s objections were part of the decision to scrap the tax.

Whereas the federal government will save the cash put aside in final 12 months’s price range for administrative prices, the potential tax income will likely be a giant loss. Treasury had beforehand forecast New Zealand would gain $479m in tax revenue from the levy between 2027 and 2029.

However Watts stated, “the forecast revenues from the introduction of a Digital Companies Tax not meet the factors for inclusion within the Crown accounts”.

A gap in income

In relation to tax, the pre-budget bulletins will all contain prices to the federal government or drops in income.

There are rumours the price range will embody adjustments to the businesses tax. However, if something, this will likely be a drop within the quantity of tax corporations pay. So once more, a drop in tax income.

The problem dealing with the federal government is the place the cash to function comes from. And the alternatives it has are restricted.

Firstly, it might enhance tax elsewhere. However that will require both a reversal of final 12 months’s earnings tax cuts, or the long-standing coverage to not goal wealth – akin to with a capital good points tax.

Or, the federal government might make drastic cuts to spending. And, contemplating the announcement that this year’s budget would be tight, with over a $1 billion reduce from the federal government’s discretionary working spending (referred to as an working allowance), this appears to be the trail they’ve taken, no less than partially.

The ultimate choice could be to borrow now to spice up infrastructure and enterprise funding within the hope that ensuing financial development will generate larger income later.

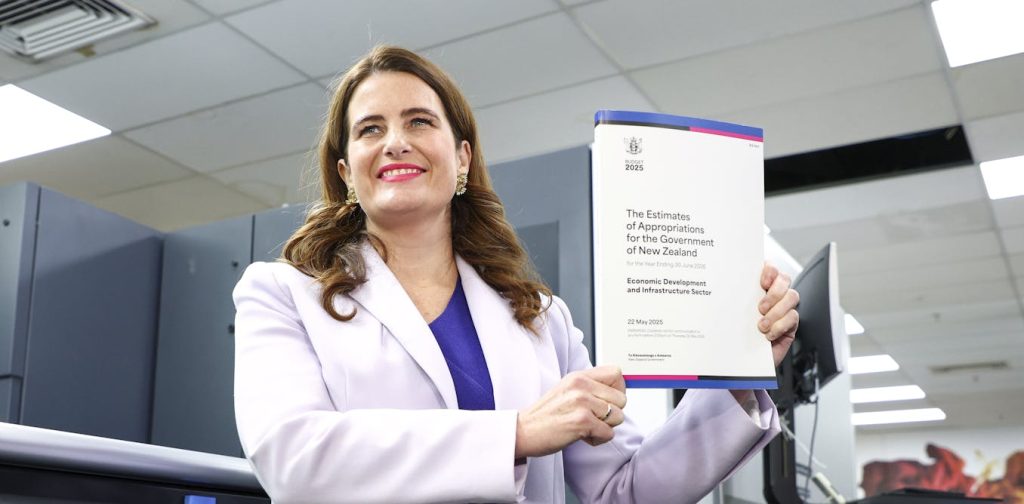

We received’t know the solutions to those questions till Price range 2025 is launched, and there have been a whole lot of combined messages. Contemplating Finance Minister Nicola Willis has dubbed this a “Development Price range”, nonetheless, it appears doubtless the main target will likely be on encouraging funding and development by way of enterprise exercise, quite than any tax will increase.