On Donald Trump’s return to the White Home, he issued an executive order banning a US “digital greenback”. A compelling new e-book, framed as a wake-up name to Western policy-makers, reveals the worldwide significance of this transfer.

It warns the West’s sluggish embrace of digital foreign money frameworks might erode its long-term monetary affect – and diminish its potential to form world financial guidelines.

Smart Money positions central bank digital currencies (or, CBDCs) as the most recent battleground in a brand new Chilly Struggle. CBDCs are digital cash issued by a central financial institution, backed (identical to money) by the federal government of the nation issuing it. Whereas the US greenback, the UK’s pound and the euro presently haven’t any digital equal, China has made speedy developments in its digital yuan (e-CNY).

Overview: Sensible Cash: How Digital Currencies will Win the New Chilly Struggle – and Why the West Must Act Now – Brunello Rosa with Casey Larsen (writer)

Governments regulate their CBDCs within the type of safe digital code. On this method, they differ from (non-public) cryptocurrencies – which Trump favours as a substitute.

Sensible Cash’s authors, monetary economist Brunello Rosa and strategic communications guide Casey Larsen, examine the rise of CBDCs to that of the web 30 years in the past.

Till final month’s ban on a US digital greenback, 130 countries, or 98% of the worldwide financial system, had been exploring a CBDC to enhance money.

The US faces partisan resistance, with payments just like the CBDC Anti-Surveillance State Act searching for to ban digital {dollars} over privateness fears. In the meantime, the European Union and UK are prioritising safeguards akin to pseudonymous transactions, to steadiness innovation with civil liberties.

Australia has no current plans to subject its personal CBDC. However ought to it?

Richard Wainwright/AAP

‘A wake-up name’

For Australia, the stakes are significantly excessive. As a resource-exporting nation with deep commerce ties to China, it should navigate the rising divide between US-led monetary programs and China’s increasing CBDC networks.

The worldwide financial order has been anchored by the US greenback since World Struggle II. Rosa and Larsen argue it faces an existential menace from China-led commerce networks amongst International South nations: together with nations like Russia and Nigeria, that are more and more aligned with China-centred multi-CBDC networks.

They warn if the West stays preoccupied with dystopian fears of digital currencies, it dangers ceding world monetary management to China.

Trump’s government order might deepen the divide in digital foreign money adoption between the US and its allies. If China continues to advance CBDC-based commerce settlements, Australian exporters might face strain to undertake Beijing’s monetary infrastructure. This is able to elevate issues about Australia’s financial sovereignty and geopolitical leverage.

The rising affect of China’s monetary infrastructure, significantly via CBDC-driven networks, creates complicated decisions for Australia in balancing financial pursuits with its strategic ties to the US.

The race for digital cash is already underway – and Australia can’t afford to be left behind.

Shutterstock

CBDCs are completely different from cryptocurrencies

Cryptocurrencies like Bitcoin are decentralised, that means they’re not issued or managed by a government. However CBDCs are state-issued and backed. This ensures their stability and makes them simpler to belief.

CBDCs are designed to operate alongside or exchange bodily money. They’re the one digital legal responsibility of a central financial institution, and symbolise a declare on its reserves. This makes them equal to money.

Sensible Cash focuses on “cash as data”. CBDCs may be programmed with sure guidelines or circumstances and combine easily with current monetary programs. Extra critically, they are often transmitted and processed over the web, enabling real-time, automated transactions. The pre-programmed funds and transactions these CBDCs enable can meet the particular wants of their issuing governments.

At its core, Sensible Cash argues CBDCs usually are not merely monetary improvements. They’re highly effective geopolitical devices, able to reshaping world commerce, financial sovereignty and the financial order. Their rise is accelerating de-dollarisation, or the decreased affect of the US greenback in world commerce and financing.

Making monetary sanctions much less efficient?

Nations weak to US sanctions, together with China, are significantly attracted to those CBDC-based settlement networks – because the US continues to weaponise its greenback.

Only one method is thru sanctions that exclude sure nations from the SWIFT system: they’ve been described as “the nuclear choice” of economic sanctions.

The SWIFT network is utilized by banks to ship and obtain data, akin to cash switch directions – together with cross-border funds.

In 2022, a number of Russian banks (together with its central financial institution) have been excluded from SWIFT over the struggle on Ukraine. From 2012 to 2016, nearly all Iranian banks have been delisted, over Iran’s nuclear program.

SWIFT exclusion has meant efficient isolation from a lot of the worldwide monetary system.

CBDC networks enable nations to bypass conventional monetary infrastructure and scale back reliance on the US greenback in cross-border commerce.

Mikhail Klimentyev/AAP

Digital cash and the commerce struggle

China’s e-CNY is designed to reshape the worldwide financial order. China’s dependence on the dollar-based monetary system makes it weak to US monetary sanctions.

By growing a state-backed digital foreign money, China seeks to cut back its reliance on Western-controlled monetary infrastructure, akin to SWIFT – and mitigate dangers that might destabilise its commerce and financial system.

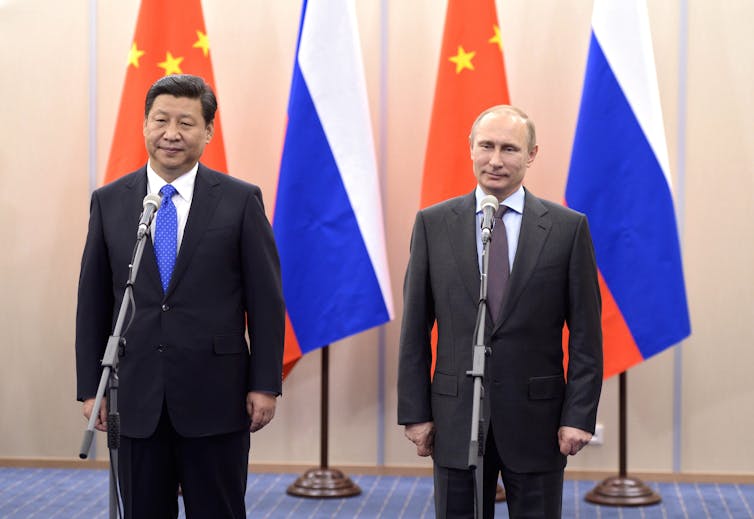

Rosa and Larsen spotlight a pivotal second within the e-CNY’s evolution. On February 4, 2022, through the Beijing Winter Olympics, Chinese language president Xi Jinping and Russian president Vladimir Putin declared a “partnership of limitless friendship”.

Quickly after, China’s yuan overtook the US greenback as probably the most broadly used foreign money for cross-border transactions in Russia. This marked the digital yuan’s first main alignment with an alternate world monetary system – and signalled a direct problem to the Western-led financial order.

Alexei Nikolsky/Ria Novosti/Kremlin Pool/AAP

“The race for digital cash,” the authors word, “is intertwined with the race to use pure sources”. China goals to combine the e-CNY into commerce involving strategic sources: significantly vitality, meals and significant minerals.

By providing an alternative choice to dollar-based monetary programs, China challenges US financial dominance, whereas tightening management over commerce routes and significant commodities.

A latest report from the Asia Society helps the authors’ arguments. It suggests a possible transfer from a (petrodollar system – the place US {dollars} are paid to oil-producing nations for his or her exports – to a digital framework for important sources dominated by the Chinese language yuan. China dominates most of those provide chains, that are important for superior applied sciences and defence.

Digital foreign money as strategic weapon

Rosa and Larsen argue Beijing goals to develop into “the chief architect of all commerce carried out in state-issued digital currencies”. First, by establishing the mandatory bodily and digital infrastructure. Then, by setting the technological requirements and guidelines.

Their e-book examines how Beijing is integrating the digital yuan into the Belt and Road Initiative (BRI), an enormous community of growth and funding initiatives around the globe, linking China to different nations via bodily and digital infrastructure. That is increasing China’s monetary affect over strategic commerce routes and markets, such because the China–Pakistan Economic Corridor and the Silk Road Economic Belt in Kazakhstan.

KHALED ELFIQI/AAP

The worldwide shift away from the US greenback (“De-Dollarization 2.0”) has accelerated since 2022. The authors examine its significance to the post-1944 rise of the Bretton Woods system, which used the gold commonplace to create a hard and fast foreign money trade charge – and to the Nineteen Seventies institution of the petrodollar.

How do multi-CBDC platforms present rising economies with an alternative choice to Western-dominated monetary programs? They streamline trade and reduce reliance on traditional financial infrastructure and reserve currencies (just like the US greenback, euro, and British pound).

As extra nations discover digital options, the potential to bypass Western-led regulatory regimes will increase.

OHAIL SHAHZAD/AAP

Two world financial blocs

This shift is dividing the world into two financial blocs. One is the G7, which consists of the US, Canada, France, Germany, Italy, Japan and the UK (UK). The opposite is the International South: nations in Africa, Latin America, Asia and Oceania which might be sometimes characterised by decrease revenue ranges and rising economies. These nations typically face challenges associated to growth and world inequality.

Ciro Fusco/AAP

BRICS – usually thought-about a major a part of the International South – initially consisted of Brazil, Russia, India, China, and South Africa. Lately, the bloc has expanded to incorporate nations like Egypt, Ethiopia, Iran, the United Arab Emirates (UAE), and most not too long ago, Indonesia – strengthening its geopolitical and financial affect.

Whereas the G7’s share of world GDP declines, BRICS+ nations are leveraging their demographic, financial and useful resource energy to counterbalance the West.

Maxim Shemetov/Pool Picture/AAP

On the similar time, Iran and different states aligned to China’s Belt and Street Initiative are deepening their monetary ties with China, to cut back dependence on Western-controlled financial programs.

Rosa and Larsen argue Trump’s protectionist insurance policies – reasonably than curbing China’s rise – have inadvertently pushed extra nations towards financial alignment with Beijing and away from the US greenback.

Is the West dropping the sensible cash race?

In areas with underdeveloped banking infrastructure, like Nigeria (which has the eNaira) and The Bahamas (with its Sand Dollar), CBDCs supply an opportunity to bypass conventional banking. They supply quick, reasonably priced monetary inclusion and worldwide transactions.

Then again, Western scepticism of CBDCs is rising. It’s pushed by fears of presidency overreach and the potential misuse of programmable cash: for geopolitical management, or transaction restrictions based mostly on location or time.

shutterstock

These issues stem from the two-tiered construction of sensible cash. CBDCs leverage decentralised applied sciences, like blockchain, for transactions. However their governance, growth and insurance policies stay firmly below state management.

Rosa and Larsen argue this centralised oversight grants governments who use CBDCs unprecedented authority over monetary exercise, together with real-time buy monitoring, transaction limits and spending restrictions.

China exemplifies this mannequin. Its CBDC infrastructure prioritises programmability and state management.

The digital yuan is built-in into China’s social credit score system, reinforcing state oversight via surveillance networks like Skynet. Skynet is a extremely subtle system that tracks people’ actions, assigning social credit score scores based mostly on their actions. (Monetary habits, adherence to legal guidelines, and even social and ethical conduct are included.)

The e-CNY enhances its effectiveness by offering real-time knowledge on monetary transactions, making it simpler for the federal government to watch and consider residents’ monetary behaviours.

An pressing warning Australia ought to heed

Sensible Cash argues CBDC growth is a strategic necessity, not simply monetary innovation. It’s an pressing warning.

The e-book’s best power lies in its potential to synthesise complicated geopolitical and monetary developments right into a cohesive narrative. The authors’ parallels between the rise of CBDCs and the web bolster their argument that “digital currencies usually are not simply upgrades, however foundational shifts in how worth and energy flow into globally”. It’s convincing.

Nevertheless, Sensible Cash’s alarmist tone typically overshadows a extra nuanced dialogue. The authors downplay challenges to China’s ambitions, together with world scepticism concerning the yuan’s convertibility, and the entrenched inertia of dollar-based commerce.

Their critique of US complacency typically paints non-Western initiatives as monolithic threats, overlooking regional nuances just like the impartial ambitions of the United Arab Emirates’ in monetary expertise.

Regardless of these caveats, the e-book gives a pointy and insightful examination of the geopolitical and monetary stakes of CBDCs.

Even a modest world shift in the direction of digital currencies might erode demand for the US greenback, weakening its borrowing energy. This is able to make Western markets, together with Australia, extra risky.

As a resource-driven financial system deeply intertwined with China, Australia should urgently reassess its monetary and financial methods in response to those shifting dynamics.