The price of residing disaster, which noticed inflation within the US peak at a four-decade high of 9.1% in 2022, performed a major position in figuring out the end result of final November’s presidential election.

Exit polls throughout ten of the important thing battleground states confirmed 32% of voters thought of the financial system to be a very powerful election challenge. Amongst that group of voters, a staggering 81% voted for Donald Trump.

Trump had spent most of his election marketing campaign saying his administration would sort out excessive costs – even vowing to bring them down on day one. Nonetheless, the newest figures counsel inflation within the US has elevated since he took workplace, rising unexpectedly to a six-month excessive of three% in January.

This rise is basically due to the financial system Trump inherited. However some consultants have expressed concerns that his said financial technique, together with commerce tariffs, main tax cuts and decrease rates of interest, will solely add to inflation.

Whereas tax cuts and rate of interest adjustments are acquainted insurance policies, using tariffs has been much less frequent in current a long time. These are utilized by governments to stability commerce relationships or in retaliation to tariffs imposed by different nations. They often make international imported items costlier whereas additionally elevating tax revenues for governments.

The Trump administration has set tariffs of 25% on all steel and aluminium imports, and imposed 10% commerce tariffs on a variety of shopper imports from China. Whereas proposed tariffs of 25% on imports from Mexico and Canada have been temporarily paused, the US has signalled its intention to introduce tariffs on imports from the European Union.

JHVEPhoto / Shutterstock

Will tariffs result in inflation?

Trump’s aides insist the tariffs received’t have a adverse impression on American customers and companies. On February 18, Peter Navarro, senior counsel for commerce and manufacturing on the White Home, told the New York Times: “It’s not going to be painful for America. It’s going to be an attractive factor.”

Navarro argues that international exporters, involved about shedding market share, will cut back the pre-tariff value they cost US importers.

However financial idea means that tariffs usually do result in greater costs. Peter Lavelle, a commerce professional on the UK’s Institute for Fiscal Research, says that evidence from Trump’s first time period – when tariffs had been imposed on photo voltaic panels, washing machines, metal and aluminium – reveals these prices had been “nearly totally handed on to home customers”, thus including to inflation.

A key purpose for the tariffs is to make US home manufacturing extra aggressive on the worldwide stage. This might convey manufacturing jobs again to the US. Manufacturing employment declined by 35% within the US from its peak of 19.6 million in 1979 to 12.8 million in 2020.

Nonetheless, there was no proof of tariffs bringing manufacturing jobs again to the US throughout Trump’s first time period. In reality, manufacturing employment remained static between 2017 and 2021.

There are fears that tariffs may as a substitute set off a commerce battle, the place nations retaliate with tariffs of their very own. Canadian officers, as an illustration, have made it clear they’ll introduce retaliatory tariffs on the US – “chosen as a way to hit notably purple and purple [Trump-supporting] states”.

Economists analyse such eventualities utilizing sport idea. A commerce battle takes the type of what economics-speak calls a “non-cooperating Nash equilibrium”, the place the financial consequence is adverse for all nations concerned.

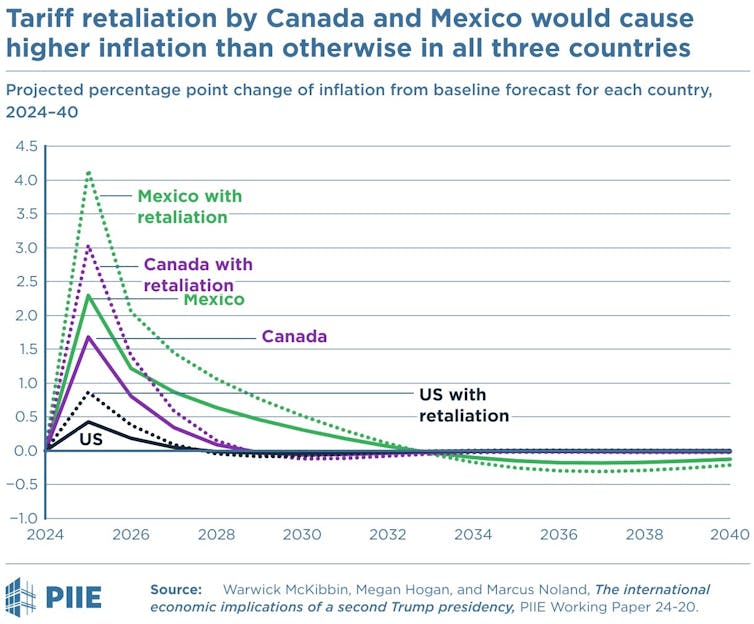

Some current modelling on the impression of Trump’s proposed tariffs on Canada and Mexico supports this view. Tariff retaliation is prone to elevate inflation charges even additional than in any other case in all three economies.

A commerce battle may additionally squeeze revenue margins for exporting producers within the US, by making some US-produced items comparatively costlier. This is able to present up in decrease actual revenue by decreased employment and wages. This consequence, like greater costs, is unlikely to be in style with US voters.

Given the proof from Trump’s first time period, it’s tough to see how tariffs will likely be something however inflationary. Trump’s proposed tax cuts valued at US$5-11 trillion would additionally add to inflationary pressures, as would the lower interest rates he has referred to as for.

Ana Swanson, a commerce and worldwide economist on the New York Occasions, believes the specter of tariffs is getting used merely as a negotiating technique. Nonetheless, like many different economists, Swanson sees uncertainty as the largest impression of Trump’s tariff coverage.

In a podcast on February 4, she stated: “In the event you, because the enterprise, are watching out for the specter of tariffs, are you going to make an funding in a brand new manufacturing unit or rent new employees?” Uncertainty results in decreased funding and decrease development.

Realistically, Trump was by no means going to convey down costs for US customers. To do this could be deflationary, and economists usually concern deflation much more than inflation. Falling costs result in deferred spending and might be devastating for financial development.

The very best consequence for US customers is that costs improve at a slower fee, near the US Federal Reserve’s inflation goal of two%. Nonetheless, given the current uptick in inflation, in addition to Trump’s technique of tariffs, tax cuts and decrease rates of interest, the course of journey all factors in the direction of greater value rises.

Latest proof from elections in lots of superior economies reveals that voters don’t like inflation, and can punish administrations who’re in energy throughout inflationary intervals.

Since inflation peaked in lots of superior economies in 2022, greater than 70% of incumbent administrations have been voted out of presidency. Trump ought to preserve this in thoughts as he embarks on his quest to make America’s financial system nice once more.