It’s laborious to maintain up with all of the tariff bulletins popping out of Washington. On February 1, the US president, Donald Trump, announced the introduction of 25% tariffs on most imported items from Canada and Mexico, and a further 10% levy on items from China. The tariffs in opposition to Canada and Mexico had been quickly postponed by a month following some token gestures.

Every week after that, Trump signed an government order imposing 25% tariffs on all metal and aluminium imports. These tariffs are set to take impact on March 12, a couple of days after the broad tariffs in opposition to Canada and Mexico supposedly come to cross. Trump has now vowed “reciprocal” duties on nations that concentrate on merchandise made within the US.

This may increasingly all sound very acquainted. Trump imposed tariffs throughout his first presidency – for instance, on metal and aluminium imports in 2018. Research of this coverage are already out there. They show that the tariffs led to rising uncooked materials prices and weakened the competitiveness of US producers.

It’s also true that the next US-China commerce struggle of 2018 and 2019 didn’t collapse the US or international financial system. However the tariffs this time spherical are extra complete and canopy a bigger variety of key merchandise and buying and selling companions. In contrast to the earlier tariffs on China, which had been launched step by step, the present restrictions are to be launched in a single transfer.

Doubtful justification

Trump justified the tariffs on Canada and Mexico as a measure to counter the “critical risk” posed by unlawful immigration and the inflow of medicine, together with fentanyl, throughout US borders. It’s troublesome to take such an evidence critically.

The fentanyl downside basically exists on the southern border. In 2024, US Customs seized about 19kg of fentanyl on the border with Canada, in contrast with nearly 9,600kg on the Mexican border. The identical is true for migrants. Imposing tariffs on Canada due to this fact makes little sense.

The extra possible motive for all of Trump’s tariffs lies in his want to guard home producers from overseas competitors. Trump and his strategists usually discuss with the necessity to scale back the US commerce deficit with the remainder of the world.

The essential downside is that in right this moment’s world of globalised provide chains, many parts are imported. Items usually cross borders a number of instances earlier than reaching customers of their last type. An excellent instance is the automotive production complex close to Detroit, the place semi-assembled automobiles steadily cross the Canadian-American border.

It’s troublesome to foretell what impact Trump’s tariffs would have on such organised manufacturing. However they might in all probability quantity to a really costly and inefficient reorganisation of manufacturing processes. If the tariffs on Canada go forward, Canadian and American corporations, in addition to their workers, would endure.

Not all areas of manufacturing can be affected so drastically. However for the numerous parts which are imported into America, a rise of their costs would translate into value pressures. This may increasingly result in monetary issues for American corporations, layoffs or greater costs for last items.

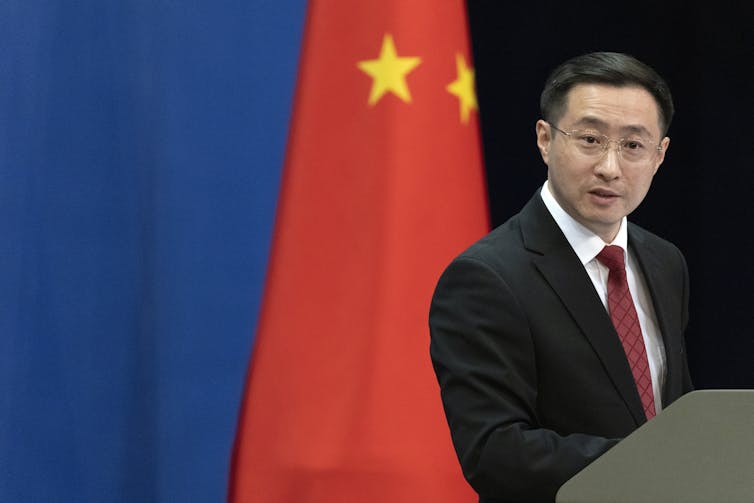

John Gress Media Inc / Shutterstock

Paradoxically, tariffs might additionally lower the competitiveness of American manufacturing, no less than in relation to gross sales in third markets. Price pressures brought on by dearer parts will have an effect on US producers, however not rival producers in, say, China or Europe – no less than till they’ve responded with a commerce struggle.

Another excuse why Trump’s logic could not work is the US greenback change fee. The greenback has soared in current months, particularly when Trump has spoken about tariffs, rising greater than 5% in opposition to the euro because the election. These strikes weaken the competitiveness of American producers on international markets.

That stated, Trump has usually expressed his want for a weaker greenback and, following the delay within the implementation of the tariffs, it has come down in worth.

However, however this, US companies are certainly not delighted. The tariffs on Canada, Mexico and China were condemned by teams such because the American Chamber of Commerce. And the Wall Street Journal described the transfer as “the stupidest commerce struggle in historical past”.

That’s not all. The first impact of tariffs is a rise within the worth of imported items. If costs go up, customers will probably be lower than enthusiastic. Excessive worth ranges had been, in any case, a key part of why Trump received November’s election.

The direct inflationary impulse from the introduced tariffs shouldn’t be, to this point, catastrophic. Whereas the inflationary results of tariffs are not a given, many economists concern they may set off a mechanism of accelerating inflation expectations. This may increasingly occur, particularly given the chance of retaliation by affected nations.

Earlier than Trump had paused the tariffs, the Canadian prime minister, Justin Trudeau, had announced retaliatory levies of 25% on American items price a complete of US$107 billion (£84.9 billion). Canada can be considering restrictions on exports of crucial minerals essential to the US tech business.

China, alternatively, announced retaliatory tariffs and measures in opposition to US companies together with Google. And the EU has stood firm on its plans to retaliate ought to Trump implement tariffs in opposition to the bloc.

Ought to they come up, greater inflation expectations could immediate the US Federal Reserve to boost rates of interest. In keeping with recent research, the rise in the price of credit score is a critical motive for dissatisfaction amongst American customers and firms alike.

Andres Martinez Casares / EPA

Lowering the commerce deficit

If tariffs don’t assist customers and damage a major variety of home producers, maybe they’ll no less than shut the US commerce deficit? Sadly, in addition they miss the mark right here.

Economists agree that the deficit is because of macroeconomic situations – particularly, the stability between national investment and saving. The US has a surplus of funding relative to financial savings, so borrows cash from the remainder of the world.

That is, merely put, as a result of the US financial system doesn’t produce as a lot because the American individuals eat. When internet home debt will increase, the commerce deficit additionally will increase as a result of the borrowed cash is spent on overseas items and providers.

Lowering the commerce hole might be completed via insurance policies that decrease home debt. Both households and companies should save extra, or authorities deficits should shrink. On this sense, tariffs are a poor software.

Trump’s tariff technique will create havoc. It will carry alternatives in addition to challenges. Europe and different affected nations ought to stand united in opposition to Trump’s tariff threats, responding firmly whereas selling commerce liberalisation the world over on the identical time.